Predictive Caltec V-Score®

Predictive Credit Scoring

Strategic Solutions for Credit Portfolio Management by Odds

Caltec Scoring Technologies, S.R.L.

Caltec Scoring Technologies provides Predictive Caltec V-Score® solutions to global credit bureaus and banking, financial, telecommunication, and commercial sectors.

Likewise, it is capable of developing applications such as V-Score®, behavioral V-Score®, V-Score® for collection purposes, insurance V-Score®, and solutions for credit portfolio management by Odds.

Caltec Scoring Technologies was founded in 2009 to specialize in developing solutions and analytic products for credit bureaus. We have over 20 years of extensive experience creating scalable software and analytic services tailored for credit bureaus and financial institutions, enabling a precise implementation to meet the client's needs. Our global presence spans seven countries: Oman, Uganda, the Dominican Republic, Ecuador, Jamaica, Honduras, and Haiti.

Why did we develop the Predictive Caltec V-Score®?

Credit is widely regarded as one of the most relevant business forms today. It creates wealth and offers consumers a foundation for progress and personal well-being.

Undoubtedly, the financial and credit services industry specializing in credit portfolio management—particularly in micro-credits, consumer credits, and mortgage credits—has experienced a positive variation globally in recent years due to the automated use of credit scoring.

Recognizing this fact and meeting the credit market's demands, Caltec Scoring Technologies developed the Predictive Caltec V-Score®, an analytical tool for accurately assessing prospect's and customers' risk.

What is Credit Risk?

Credit risk is the possibility and probability that a consumer or debtor fails to pay his obligations according to the agreed terms.

The concept of credit risk encompasses the likelihood of a payment default with the contracted debt and the creditor's position, who would bear the consequences or financial losses if the default happens.

Do not play dice with your investment. Assess in a precise manner the credit risk associated to prospects and customers.

What is the Predictive Caltec V-Score®?

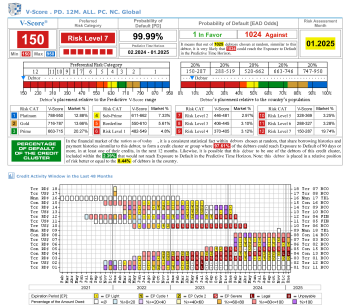

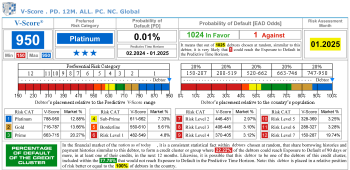

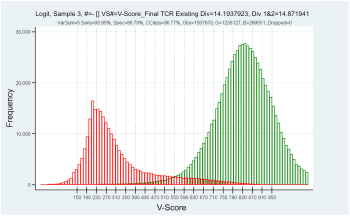

The Predictive Caltec V-Score® is a number called credit score or “V-Score®”, which measures the credit risk calculated from the information in the consumer's credit report. It is calculated using mathematical and statistical methods, including the most precise methodologies and techniques of linear regression and logistic regression.

The primary goal of the V-Score® is to measure the credit risk associated with a consumer, using as a foundation that such a consumer will NOT have, in at least one of his credits, a default of 90 days or more in the next 24 months.

The Predictive Caltec V-Score® can't guarantee that the consumer will be “good” or “bad” in the near future. We must accept that there is some level of uncertainty in any credit negotiation.

The measurement or quantification of credit risk refers to an inferential propensity or tendency that we can associate with the debtor's capacity to fulfill or fail the agreed payment in the near future.

This tendency is linked to all the debtors that share similar credit histories, conforming groups, or “clusters” of similar consumers regarding debt and payment history.

Since they are debtors with similar characteristics, credit risk will be measured using the same predictive equations to ensure that when the consumer's credit history is assessed, they will be offered a consistent, objective treatment with a forecast value that works to prognosticate their probable payment behavior in the near future.

For the development of Predictive Caltec V-Score®, we assume that the future will reflect the near past. We begin by assuming that knowledge and the debtor's credit history analysis can be utilized to predict their probable payment behavior in the near future.

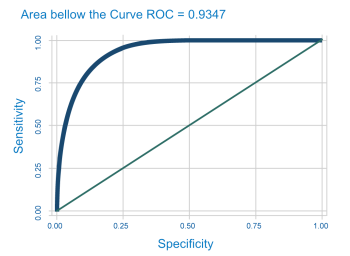

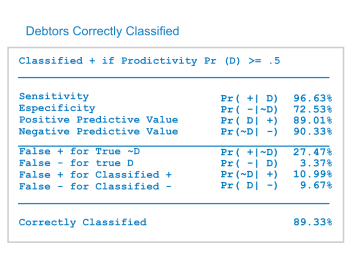

The Predictive Caltec V-Score® was developed using a methodology based on probabilistic, mathematical, and econometric models that measure variables and data to provide valuable information for credit decision-making. This involves actuarial statistical assessments through specialized computer programs designed for retrospective and inferential trend analysis.

Variables that support the Predictive Caltec V-Score®?

The Credit Report information used to develop and calculate the V-Score® is grouped into the following five [5] categories of variables:

- Payment History

- Amounts Owed

- Recent Credits Performance

- Credit Types in Use

- Credit History Length

Combined under determined selection criteria and segmented into clusters of similar characteristics, this group of variables is converted into thousands of modular variables that allow the design of powerful predictive models.

This unique process of the Predictive Caltec V-Score® warrants its high predictive power and powerful discriminative capacity, allowing a precise distinction between debtors cataloged as in Default and those who are not in Default.

How is Credit Risk measured?

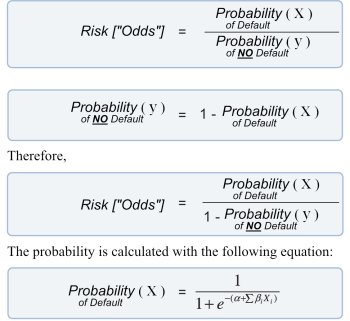

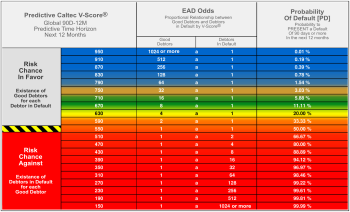

Credit risk is measured in terms of the probability of a payment default. This probability is theoretically expressed as risk chances, called “Odds” or probability ratios.

Odds are calculated, obtaining the quotient between the probability of default and the likelihood of NO default.

In this formula, e is the Euler constant [ e ≈ 2.71828], α is the model constant, βi is each variable's coefficient, and Xi the Credit Report variables included in the predictive model.

The resulting number of the division between two probabilities is difficult to comprehend, so it is mandatory to simplify its representation.

Using the proportional relations format is more practical. A risk expression, such as Odds of 32 to 1, is easier to understand than a non-dimensional number that does not allow us to establish a comparative reference in our minds.

The probability of a 90-day or more default is calculated using the resulting equation of the logistic regression, which provides the coefficients [βi] applicable to the variables [Xi] of the credit report included in the predictive model's development.

Probability, a number between 0 and 1, calculates the risk chances or “Odds.”

A formula is applied to this value, producing a decimal V-Score®. This V-Score® is transformed into the Predictive Caltec V-Score® after a linear equation is used to create its scale.

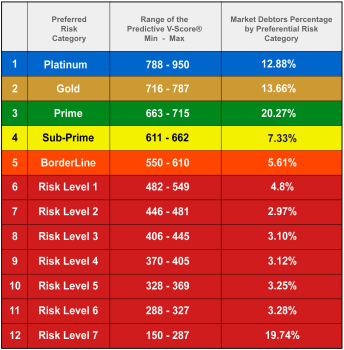

Predictive Caltec V-Score® Scale

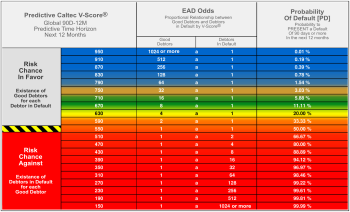

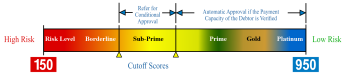

The scale for the Predictive Caltec V-Score® ranges from a minimum of 150 points for the worst V-Score® to a maximum of 950 points for the best V-Score®. The midpoint is 550 points.

From a probabilistic point of view, the scale for the Predictive Caltec V-Score® was designed so that for every 40 points incremented above 550, the Risk Chance or Odds are reduced twice as much.

On the other hand, the risk chances are doubled for each 40 points reduced in the scale below 550 points.

For instance, odds in favor of 32 to 1 mean that for every 33 debtors, 32 [96.97%] will probably not have a credit in default over 90 days or more in the next 12 months. On the other hand, just one debtor will present this default classification in at least one of his credits.

Likewise, odds against 1 to 8 mean that for each of nine [9] debtors, probably 8 [88.89%] will be overdue in at least one of his credits for 90 days or more in the next 12 months. This also means that one of the debtors will not have this overdue pattern.

For the V-Score® at 550 points, the Odds are 1 to 1, and the probability that the debtor presents a credit overdue for 90 days or more is 50%.

The credit risk associated with a debtor with a V-Score® of 550 points will be equal, talking in figurative speech, to flipping a coin in the air.

In this example, the uncertainty principle remains independent of which side the coin falls on since each option has a probability of 50%.

Scale Category for Predictive Caltec V-Score®

How does the Predictive Caltec V-Score® Benefits Creditors?

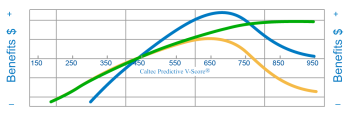

The Predictive Caltec V-Score® enables creditors to adopt a swift, uniform, objective credit evaluation policy. This approach allows creditors to accurately evaluate the credit risk linked to their prospects and customers while establishing the “cutoff V-Score®” that optimizes benefits and minimizes economic losses related to their productive activities.

The implementation of the Predictive Caltec V-Score® provides the following value-added benefits:

- It allows the creditor to make decisions that are fully informed of the risk levels associated with his prospects and customers.

- This contributes to the efficiency of each evaluation, the reduction of operational costs, and the considerable reduction in the time required to process the credit application.

- This makes implementing an automated credit scoring evaluation system viable for credit decisions. The Predictive Caltec V-Score®, synchronized with the selection criteria or variable filters, allows the creditor to use evaluation systems that satisfy its business goals and product placement.

- It strengthens the Risk Management System [RMS], which is supported by the Predictive Caltec V-Score®, that allows an automated control daily, weekly, and monthly of the credit risk variation associated with his prospects and customers to achieve:

- The creditor will be informed immediately when a variation of credit risk occurs so they can take prudent and protective measures at the appropriate time and their discretion.

- The creditor makes strategic business decisions to increase credit sales.

- It contributes to reducing, to a minimum, the inherent subjectivity based on human judgment and promotes granting objective and fair treatment to all customers.

- It makes it possible to monitor the customer's credit performance over time adequately.

- Improving customer relationships can be helpful and substantially increase the loyalty and retention of good customers.

- It establishes prices in terms of risk, and the Predictive Caltec V-Score® generally allows interest rates to remain low in the financial markets.

Implementing a Credit Evaluation Policy

Credit Portfolio Management by Odds

In today's financial world, credits and their associated risks are evaluated individually. However, this decision is often made in the context of a global policy applicable to a credit portfolio.

Therefore, the Predictive Caltec V-Score® becomes an essential element in Credit Portfolio Management by Odds.

By correctly combining the probabilities table of the Predictive Caltec V-Score® with the matrices from the V-Score® application and the affiliate's behavioral V-Score®, the credit analyst can design and implement risk measurement systems capable of calculating the profits and expected losses per customer or for a group or “cluster” of customers over a period that may extend to 24 months.

That way, risk analysts will be able to define credit policies that maximize benefits and estimate in advance the losses associated with their credit portfolios.

Depending on the business plan and the projected growth of a financial institution's credit portfolio, the credit analysts implementing these plans can make the best possible risk-based credit decisions. They can balance the anticipated benefits with the likely losses within a framework of analytical and business strategies that range from the most conservative to the most aggressive ends of the plan.

Compliance with Basel 3.1 Regulations

The Predictive Caltec V-Score®, as an effective analytical risk tool, can be used by Commercial Banks to comply with the Basel III regulations:

- For calculating the “PD” or “Probability of Default,” the “EL” [“Expected Loss”] and “VAR” [“Value at Risk”], among other indicators.

- In the possible internal rating related to the debtor credit risk.

- In compliance with the capital forecasted by the protocol “TIER 1” concerning the minimum capital requirements,

Therefore, the Predictive Caltec V-Score® will be an essential analytical tool for banks willing to implement an IRB (Internal Rating Base) in basic or advanced mode.

Predictive V-Score® ProfitMax Tools Available

- Global Predictive V-Score® for Consumers.

- Global Predictive V-Score® for Companies.

- Global Predictive V-Score® Telecom for Consumers.

- Global Predictive V-Score® Telecom for Companies.

- Predictive V-Score® for affiliates for Consumer Loans.

- Predictive V-Score® for affiliates for Consumer Credit Cards.

- Predictive V-Score® for affiliates for Corporate Loans.

- Predictive V-Score® for affiliates for Corporate Credit Cards.

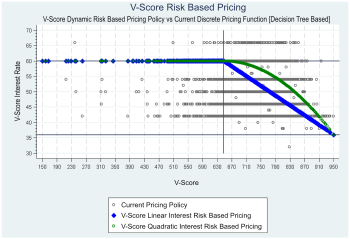

- V-Score Dynamic Risk Based Pricing Tool versus current discrete pricing function [Decision Tree Based].

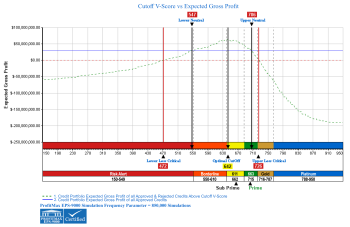

- Calculate the optimal V-Score® Cutoff of the Credit Portfolio to maximize profit.

- The Monte Carlo ProfitMax ELS-9000 Simulator allows you to calculate a credit portfolio's expected loss and value at risk (VAR) for the next 3 months.

- The Monte Carlo ProfitMax ELS-9000 Simulator allows you to calculate a credit portfolio's expected loss and value at risk (VAR) for the next 6 months.

- The Monte Carlo ProfitMax ELS-9000 Simulator allows you to calculate a credit portfolio's expected loss and value at risk (VAR) for the next 9 months.

- The Monte Carlo ProfitMax ELS-9000 Simulator allows you to calculate a credit portfolio's expected loss and value at risk (VAR) for the next 12 months.

- The Monte Carlo ProfitMax ELS-9000 Simulator allows you to calculate the expected provision amount of a credit portfolio for the next 3 months.

- The Monte Carlo ProfitMax ELS-9000 Simulator allows you to calculate the expected provision amount of a credit portfolio for the next 6 months.

- The Monte Carlo ProfitMax ELS-9000 Simulator allows you to calculate the expected provision amount of a credit portfolio for the next 9 months.

- The Monte Carlo ProfitMax ELS-9000 Simulator allows you to calculate the expected provision amount of a credit portfolio for the next 12 months.

- Risk Management System for the periodical automated control of the credit risk variation associated with prospects and customers.

Calculation of the Optimal Cutoff V-Score® for the credit portfolio to achive profit maximization

How does the Predictive Caltec V-Score® Benefit Consumers?

Using the Predictive Caltec V-Score® makes it viable for creditors to quickly measure the credit risk associated with consumers.

Before the Predictive Caltec V-Score®, the credit approval process was slow, inconsistent, and based on subjective and unfair evaluation criteria.

The Predictive Caltec V-Score® has the following benefits:

- Consumers can obtain credit quickly.

- Reduces the subjectivity inherent in decisions based on human judgments in the credit approval process and promotes the objective and fair treatment of all consumers.

- Information errors associated with credits are removed from the credit approval process.

- Consumers have more credit opportunities available.

- A higher Predictive Caltec V-Score® can lower consumer interest rates, lowering credit risk. A higher Predictive Caltec V-Score® increases the possibility that consumers will obtain the credit approval required to purchase the necessary goods and services.

Predictive Caltec V-Score® Scale

Final Note

The Predictive Caltec V-Score® will allow financial institutions to benefit from this predictive tool, which has proven effective for developing and monitoring credit portfolios. Likewise, the Predictive Caltec V-Score® is a key element in the financial risk evaluation process.